Introduction

Last year, I made some observations and predictions for 2025 (linked here). I offered four predictions about 2025: some held up, others didn't. This piece grades that work and lays out new predictions for 2026. If nothing else, it's a way to hold myself accountable in public.

Let’s start by grading my predictions:

1. AI is hot, but most of the world still just needs server updates

AI is hot, but most of the world still just needs server updates: basically, while we certainly got our fair share of work in the generative space, most organizations are still trying to catch up to the previous eras (mobile and cloud). People still need well-designed websites, database migrations, infrastructure modernization, and site reliability, not just chatbots. There’s still plenty of work to be done in more traditional technology spaces, even with LLMs and agents sucking the oxygen out of the room.

Verdict: Partially wrong.

This is less a prediction and more an observation, but directionally, this held true for Sitebolts in 2025. Our work focusedon IT modernization, cloud, and technology infrastructure. But uh it seems the broader market tells a different story.

Public IT firms like Accenture serve as a counter to our anecdata: they reported $69.7 billion in 2025 revenue, with $5.9 billion in GenAI bookings (3x their 2024 GenAI revenue). GenAI growth outpaced consulting and cloud migration. That contradicts my prediction. But here's where it gets interesting: just this week, Accenture disclosed Q1 data:

Q1 advanced AI bookings were $2.2B (+76% YoY)

Q1 advanced AI revenues were $1.1B (+120% YoY)

Good news for them. But embedded in their announcement is a subtle signal:

After this quarter, Accenture will stop sharing AI bookings and revenue separately and will roll those numbers into their broader consulting and managed services divisions. This might seem like a simple accounting tweak, but if you squint, you can see this might read as…bearish on these AI services. They're essentially discontinuing separate AI reporting, which begs the question : if you believed AI would sustain explosive standalone growth, why hide it in the aggregate numbers? Worth monitoring.

My refined prediction for 2026:

I’m going to double down:

In 2026, the majority of technology services and work will focus on cloud, modernization, and infrastructure. GenAI will not be a separate or distinct driver of growth.

2. Processes and systems must always prioritize people

Processes and systems must always prioritize people: amidst our battles to manage internal and external projects with greater efficiency, as well as the challenges our clients encounter with new systems, we continue to observe that throwing more SaaS and AI tools at management dilemmas will never be enough. If your team isn’t fully embracing and utilizing these tools, the efficiency gains they promise will never materialize. In most organizations, this adoption should genuinely be bottoms-up. With that said, we have found success with Linear for corporate-wide task tracking, GitHub and Discord for the usual comms and version control, and have rolled out our own custom internal monitoring and alerting tools (cleverly dubbed Sitebolts Monitor).

Verdict: Confirmed by data.

Another sort of observation, sort of prediction. The implicit prediction is that companies will not capture the efficiency gains of technology without changing their actual processes and systems, which is tough to validate, but that’s what vibes-based analysis is for. We can imagine validating this through the rate of successful SaaS, AI, and technology adoption from prototype to production. The usual issue with technology adoption (aka what leads to value capture) is almost always change management (the people, not the tech). If that’s our framing, then we just need to look at reports on successful production usage of SaaS and AI products. Mainstream ones are:

The infamous MIT “State of AI Adoption” study shows that despite billions in enterprise investment into GenAI, “95% of organizations are getting zero return.” The study concluded that “The dominant barrier to crossing the GenAI Divide is not integration or budget, it is organizational design. Our data shows that companies succeed when they decentralize implementation authority but retain accountability.”

Ramp’s AI Adoption Index reported that “AI business adoption plateaus but remains 4.5x higher than U.S. Census estimate. At 42%, actual AI business adoption continues to be significantly higher than the U.S. government’ssurvey-based estimate of 9%.” This presents a somewhat more favorable picture on successful AI adoption, withthe caveat that Ramp is sampling spend data from their own customers (who tend to be startups or early adopters, as opposed to older // more traditional enterprises.)

Looking at broader technology adoption, everyone’s favorite market research firm, Gartner, noted that only 48% of digital initiatives enterprise-wide meet or exceed their business outcome targets after surveying 3,100 CIOs and technology executives, and more than 1,100 executive leaders outside of IT (CxOs). This number feels directionally correct when you think about the “75% of IT projects fail” that gets trotted out at every project management course. These things are hard.

My refined prediction for 2026:

Organizations will continue to struggle to successfully integrate technology into their operations unless they innovate at the org design layer. The most successful technical adopters will be the ones that prioritize how they organize their humans, not their tech.

3. Open-source is at a crossroads

it’s vibes-based, but a lot of trends feel like they’ve come to a head in 2024. The WordPress saga (conveniently covered here), the battle to define “open-source” LLM models, the metamorphosis of non-profits to profits, and so many different lawsuits on intellectual property & training data all point to a feeling that we’re at a precipice, that perhaps certain long-held paradigms & social contracts are shifting. While I can’t offer certain predictions, something tells me next year will birth new governance types, new precedents, and some very weird public-private things.

Verdict: (humbly) Dead on

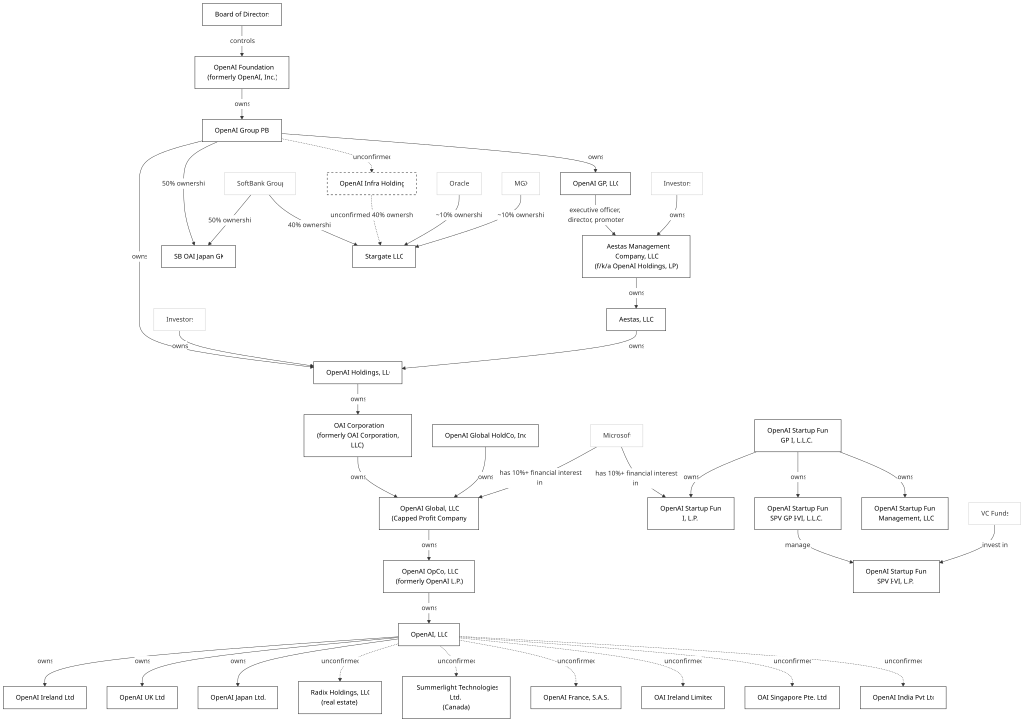

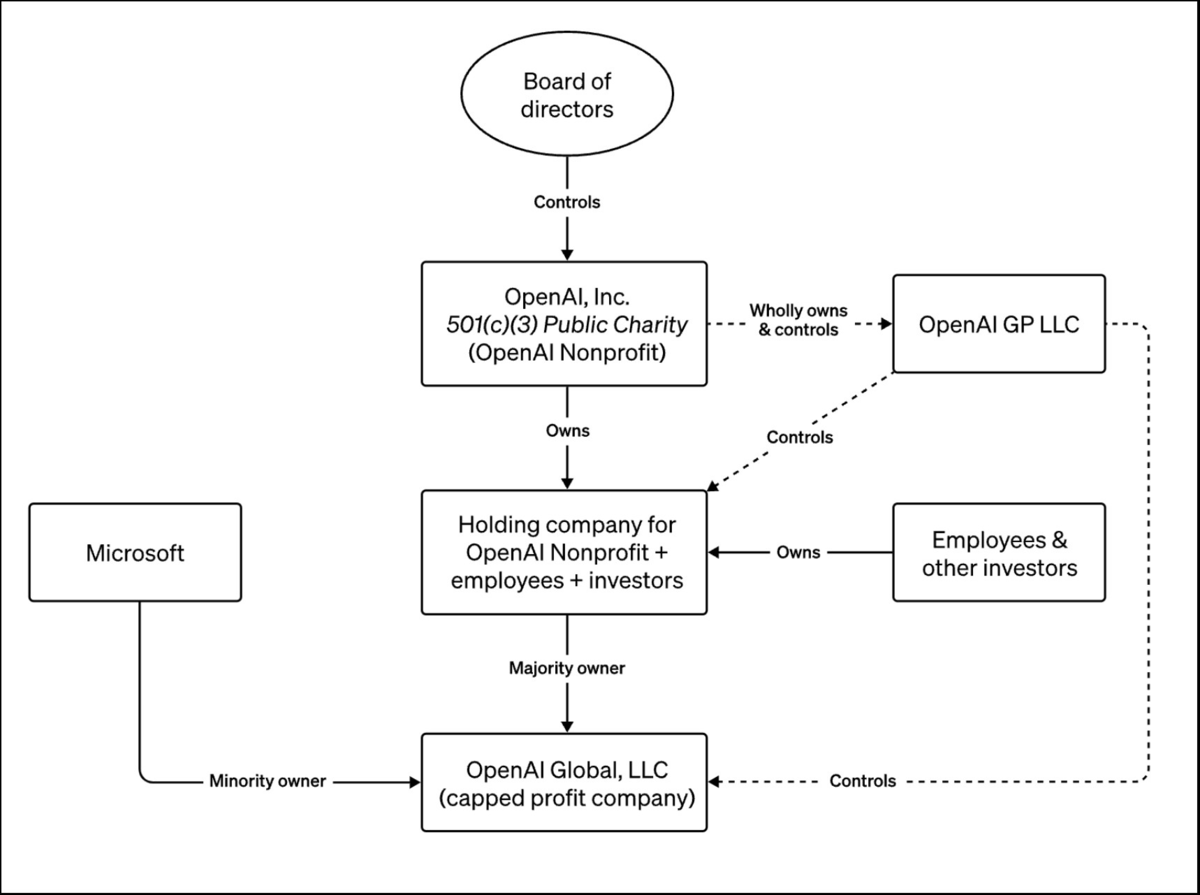

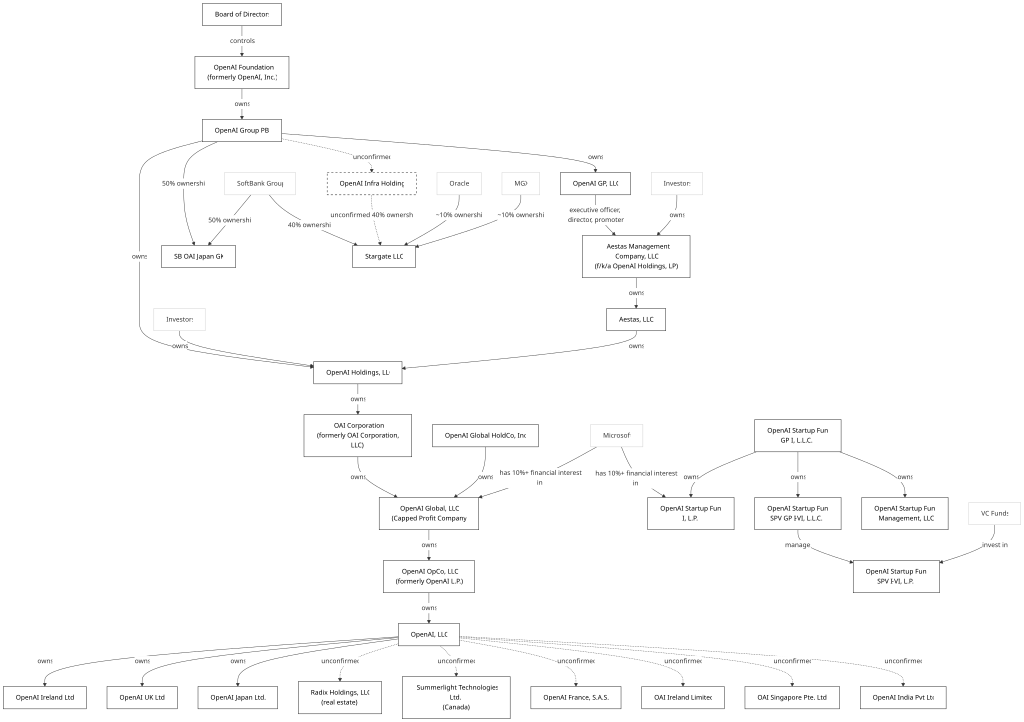

A more explicit prediction than the first two, this one feels like a resounding success. There are many weird governance situationships that popped up in 2025, I don’t even know where to start! There’s Stargate, the sort of private (OpenAI, Softbank, Oracle) and sort of public (…the US government) partnership that is going to (maybe) build out the largest infrastructure rollout since the New Deal for data centers. OpenAI itself is a wonderful specimen of unusual governance. Their battle to figure out a structure that allows them to IPO has been in the background all 2025. Originally, there was the non-profit entity controlling the for-profit LLC, which controlled the holding company for equity holdings between employees and investors, which was the majority owner of another LLC operating as a “capped for-profit company.”

Believe it or not, it somehow got more complex in 2025! In OpenAI’s own words, they were “founded in 2015 as a nonprofit. Its mission is to ensure that artificial general intelligence benefits all of humanity.” Then “in 2019, we created a for-profit subsidiary to help us scale our research and deployment efforts. This for-profit has always been governed and controlled by the nonprofit.” On October 28, 2025, they rolled out this new structure:

The nonprofit is now the OpenAI Foundation. The for-profit is now a public benefit corporation, called OpenAI Group PBC, which—unlike a conventional corporation—is required to advance its stated mission and consider the broader interests of all stakeholders, ensuring the company’s mission and commercial success advance together (emphasis mine)

The OpenAI Foundation continues to control the OpenAI Group. It now holds conventional equity (emphasis still mine) in OpenAI Group – with all stockholders participating proportionally in any increase in value of the OpenAI Group – aligning long-term incentives around impact and growth. (once again, emphasis is mine). OpenAI Foundation and OpenAI Group have the same mission.

Here’s a new diagram:

That’s a lot more boxes and arrows. The last time I tried to parse a governance structure this weird was....uh something that rhymes with ShAlameda Research.

My prediction for 2026:

The amount of strange governance structures will accelerate in this corporate game of musical chairs until one of the research labs tries to go public. This will make the music stop (for a bit at least).

4. ‘GPT wrappers’ are cool, actually

‘GPT wrappers’ are cool, actually: at the start of the generative AI era (let’s say the release of ChatGPT a couple of years ago), a common observation was that the advantage lay in the underlying large language models and hardware. The second part of that observation was that the disadvantage was in the application layer, and the derogatory “just a wrapper on OpenAI” got tossed around. This past year has shown evidence that it might be the other way around. As the models have undergone a “commoditization” effect from the intense competition at the hyper scalers and research labs, there’s been more development happening from the application perspective. In the enterprise and startups, vertical applications using the underlying models (almost interchangeably) have become both valuable and (dare I say) useful. I think 2025 will be the year of the first couple majority adopted non-chatbot LLM-based applications.

Verdict: Correct

Hmm, this is the most explicit prediction of the lot. My vibes-based validation wants to admit victory from the start, given some top non-chatbot LLM-based applications in the headlines: Cursor, Zed, Harvey, [INSERT YOUR FAVORITE CODING IDE HERE].

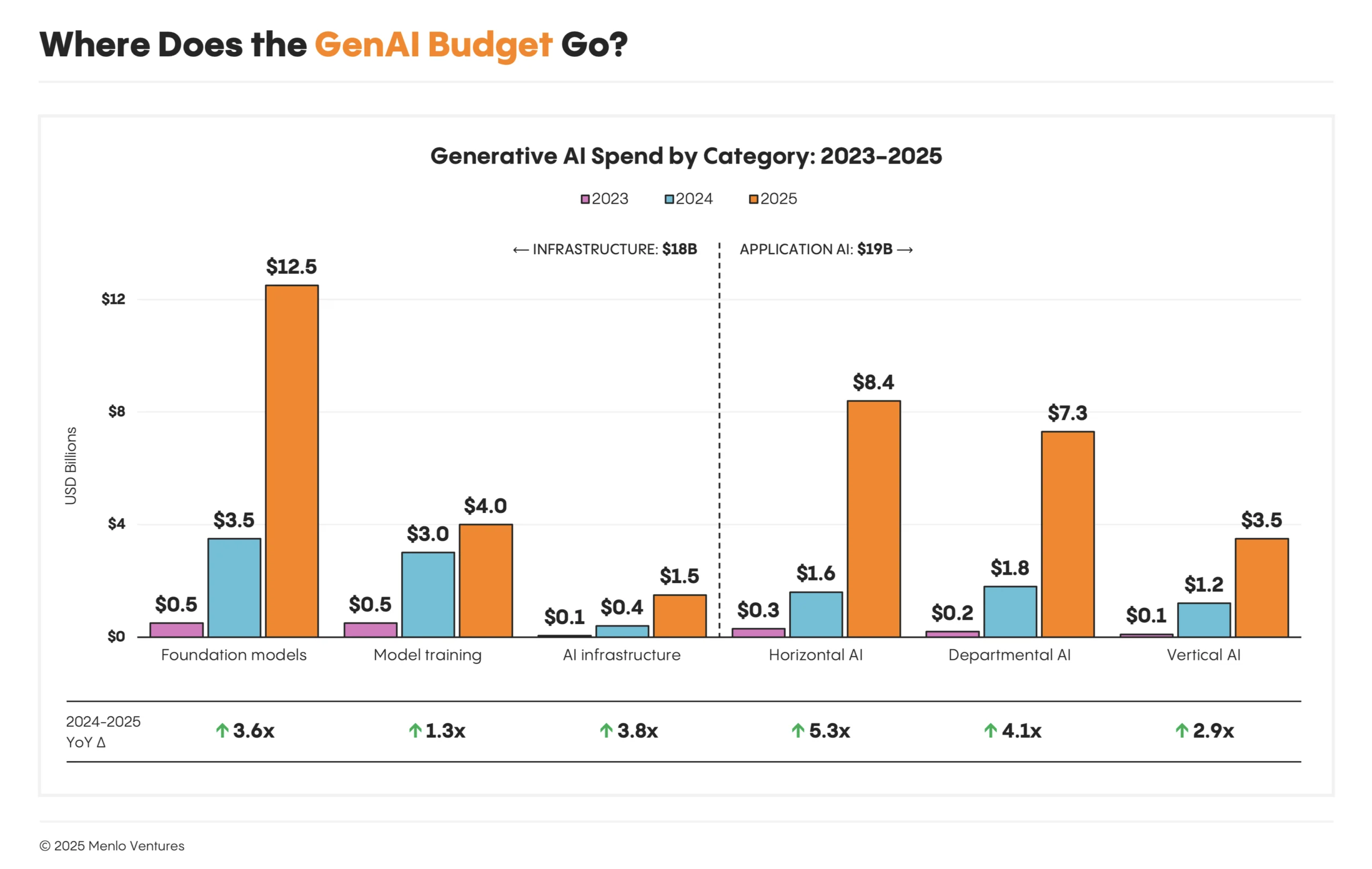

But how can we be a bit more rigorous about judging this prediction? With insider data of course. Menlo Ventures is a storied VC firm that goes back to the original wave of investors in the valley. They recently released their State of Generative AI in the Enterprise report, based on a survey of 495 U.S. enterprise AI “decision-makers” in November 2025. These decision-makers were executives, VPs of Engineering and Product, and general technical leaders that control AI purchasing and development decisions at companies using AI tools (this survey has all the biases and noise that you may imagine.) With that said, here are some interesting points:

In 2025, companies spent $37 billion on generative AI, up from $11.5 billion in 2024. This is a 3.2x year-over-year increase, measured as dollars that went to foundation models, model training, AI infrastructure, and AI applications from both startups and incumbents.

The largest share, $19 billion, went to user-facing products and software leveraging underlying AI models, aka the application layer. This represents over 6% of the entire software market (editor’s note: this is me taking a victory lap.)

The application layer splits into three categories:

Departmental AI ($7.3 billion), designed for specific job roles like software development or sales;

Vertical AI ($3.5 billion) targets industries such as healthcare or finance.

Horizontal AI ($8.4 billion) is increasing productivity across all functions.

My prediction for 2026:

Enterprise AI spending on foundation models has peaked and will only decrease. From this point forward, application spending will only increase.

Summary: 3 out of 4

So, looks like according to both vibes and data, we’re sitting at about 3/4 correct predictions (if my readers are being generous). The first prediction—that AI wouldn't displace infrastructure work—was partially wrong for the broader market, though it held for Sitebolts. The other three proved accurate. The pattern: predictions about organizational behavior and market structure held up better than predictions about market size. That's worth noting going into 2026.

Predictions for 2026

Based on this track record, here are four predictions:

The majority of technology services and work will focus on cloud, modernization, and infrastructure. GenAI will not be a distinct or separate driver of growth; instead, it will be bundled into different areas in much the same way that Accenture is doing.Organizations will continue to struggle to successfully integrate technology into their operations unless they innovate at the org design layer. The most successful technical adopters will be the ones that prioritize how they organize their humans, not their tech.The amount of weird governance structures will accelerate in this corporate game of musical chairs until one of the research labs tries to go public. This will make the music stop (for a bit at least).Enterprise AI spending on foundation models has peaked and will only decrease. From this point forward, application spending will only increase.

We’ll check back next year to see how we did.